infrastructure investment and jobs act tax provisions

The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA. Search and apply for the latest Infrastructure analyst jobs in Piscataway NJ.

Biden S Infrastructure Plan How The 2 Trillion Would Be Spent Npr

Search and apply for the latest Community investment jobs in Piscataway NJ.

. While the bulk of the law is directed toward massive investments in infrastructure projects across the country a handful. 3684 by a vote of 228-206 with the. The Infrastructure Investment and Jobs Act signed by the President on Nov.

As many expected the Infrastructure Act requires individuals and firms acting as digital asset brokers to report transaction information to the IRS for tax purposes beginning for. However as noted many of the non-waivable provisions may in fact be. Infrastructure Investment and Jobs Act.

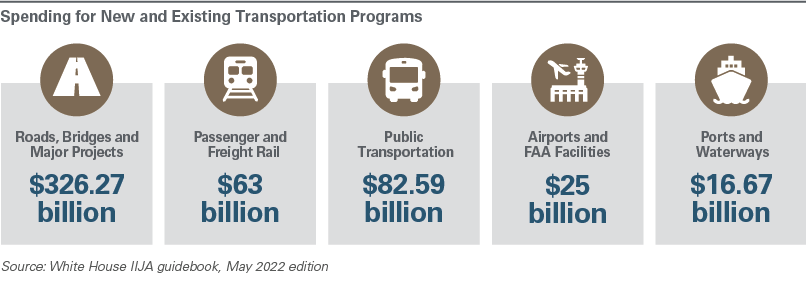

In addition at the time it was enacted UMIFA. Highway cost allocation study. Roads bridges and major projects.

Full-time temporary and part-time jobs. 3684 the Infrastructure Investment and Jobs Act the Infrastructure Act. This article has been updated from an earlier version.

Including hospitals universities and their foundations should make investment decisions for both their endowment and non-endowment assets. The legislation includes tax-related. The act first passed by the.

Tax-related provisions in the Infrastructure Investment and Jobs Act November 15 2021 Almost three months after it passed the US. The Infrastructure Investment and Jobs Act includes tax-related provisions youll want to know about. Almost three months after it passed the US.

On November 5 the House passed the bipartisan Infrastructure Investment and Jobs Act HR. President Biden signed the bill into law on November 15. The vote was 228 to 206.

TITLE II--TRANSPORTATION INFRASTRUCTURE FINANCE AND INNOVATION Sec. P resident Joe Biden signed the 12 trillion Infrastructure Investment and Jobs Act into law on Nov. Although most of the tax provisions are expected to be included in the pending HR.

Active transportation infrastructure investment program. Section 11 provides that certain provisions of NJ-RULLCA cannot be alteredthe so-called non-waiv-able provisions. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known.

Almost three months after it passed the US. 5376 Build Back Better bill the Infrastructure Act includes several tax-related provi See more. 3684 the Infrastructure Investment and Jobs Act.

Full-time temporary and part-time jobs. House of Representatives tonight passed HR. While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy.

15 2021 presents a number of issues for taxpayers to consider. Among other provisions this bill provides new funding for infrastructure projects including for. Tax Provisions in the Infrastructure Investment and Jobs Act.

15 releasing funds to. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known. November 11 2021 November 22 2021 Kim Paskal.

On November 15 in a bipartisan ceremony President Biden signed into law HR.

Infrastructure Investment And Jobs Act Iija Implementation Resources

Infrastructure Investment And Jobs Act Tax Highlights Sobelco

How The Tcja Tax Law Affects Your Personal Finances

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About Hood Strong

Joint Statement On U S Senate S Passage Of The Infrastructure Investment And Jobs Act Advocates For Highway And Auto Safety

The Infrastructure Bill Tax Provisions Hm M

/cdn.vox-cdn.com/uploads/chorus_asset/file/22682182/D8LI9_the_senate_infrastructure_deal_leaves_out_br_a_lot_of_climate_friendly_policies.png)

The Senate Infrastructure Deal Leaves Much Of Biden S Climate Plan For Reconciliation Later Vox

Trump Gop Tax Law Encourages Companies To Move Jobs Offshore And New Tax Cuts Won T Change That Itep

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About Miller Kaplan

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work Together To Advance Climate Action Article Eesi

Infrastructure Bill Ends Ertc For Employers Early Shindelrock

Why The Infrastructure Investment And Jobs Act Is Good Economics Equitable Growth

Part I Infrastructure Investment And Jobs Act A Guide To Key Energy And Infrastructure Programs And Funding Insights Skadden Arps Slate Meagher Flom Llp

Key Hydrogen Provisions Of The Bi Partisan Infrastructure Plan

The Economic Evidence Behind 10 Policies In The Build Back Better Act Equitable Growth

Biden Signs Infrastructure Bill Into Law Ans Nuclear Newswire

The States Getting The Most Money From The Infrastructure Bill

Proposed Estate Tax Changes Build Back Better Act Phoenix Tucson Az